Do not disclose your password to anyone (including Promise staff and the police). Our Company does not directly promote loan products to individuals, require customers to repay loans or request personal information through WhatsApp, WeChat or Facebook. Please click here to know the details.

Being a business owner or freelancer, you may face cash flow problems due to unpredictable revenue. Promise's revolving loan scheme allows you to withdraw approved revolving loan amount at any time, with the ability to adjust the repayment period and amount, to solve your immediate cash flow needs conveniently and flexibly.

Apply for a revolving loan without additional application procedures. You can withdraw approved credit anytime.

Repayment period varies from 3 to 84 months, with no handling fees and penalties for early repayment. Promise calculates interest daily, allowing you to save unnecessary expenses. Easy loan and easy pay!

Your application, loan agreement signing, and fund transfer will all be completed online.

Re-application is required every time, while loan approval and fund transfer consume time.

Approved credit can be withdrawn and re-financed anytime through website or 24-hour member hotline, without additional application.

Require to visit a branch in person to pick up the loan in the form of a cheque during office hour.

Loan is transferred to your bank account via Faster Payment System (FPS) anytime once approved^.

Fixed monthly repayment amount which is normally higher than the minimum repayment amount of revolving loan, resulting in higher pressure to repay.

Repayment period can vary up to 84 months. You can either pay the minimum repayment amount or adjust the repayment amount and period flexibly according to personal financial status, to ease the pressure.

❝PROMISE helped me clear my credit card payment at a low interest rate, so I could pay it off faster and save more!❞

❝With PROMISE revolving loan, I can get fund whenever I need and ensure more stable cash flow!❞

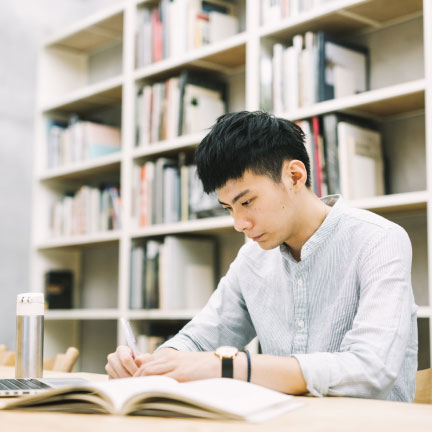

❝Flexibility is key in life. PROMISE's loans are applicable for university students as well, helping them get through times of hardship.❞

❝I have compared personal loan solutions which offer express approval from several loan providers, and applying via PROMISE's online platform is definitely the simplest and most convenient!❞

❝Even if I was out of budget, all the application procedures for Emergency Loan, including approval and signing contract can be done online, enabling me to quickly get cash in an emergency.❞

❝The PROMISE short-term loan was a great help to my daughter, it was approved speedy even with no income proof!❞

❝PROMISE did not need me to show up in person for my loan application, even when I had no proof of income!❞

No fixed monthly repayment amount or repayment period is set, which allows repaying only the monthly minimum balance, or you can choose to repay the full amount anytime. Credit limit will resume right after repayment, and available for withdrawal anytime without re-application, providing higher flexibility on both borrowing and repayments.

Revolving loan is flexible and well-suited for anyone, especially for people who is self-employed or the owner of small and medium business. Revolving loan gives you and your business an easy and flexible access to a revolving line of credit for your cash flow or working capital requirement. You can also apply for the revolving loan in advance as an aside funds for the unexpected.